Ftax VAT Web form Overview

![]()

We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

The Ftax VAT is now available as a web form and has the same look and feel as the SA100, SA800, SA900 and CT600 web forms. If you have previously used the Ftax VAT PDF form you can use the web form without requiring another credit.

Please note that the MTD software system from HMRC requires users to grant authority to the software that they use to make submissions. You only need to do this once for each software supplier you use and the authority is valid for 18 months. The web form will redirect you to the correct part of the HMRC website if granting authority is necessary. If you have previously used the Ftax PDF VAT form this may not be required, the form will tell you if the authority needs to be updated.

The website will default to the current year. If you require forms from a previous year, click the left arrow next to the current year.

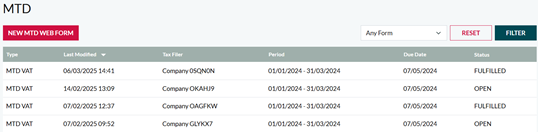

To begin your submission, login to your Ftax account and select the red 'New' button from the MTD row of the web forms table.

Select the client type you require from the dropdown list.

If you have already submitted your VAT using Ftax, you can select the existing user by clicking the red button and selecting from the dropdown list.

When you have clicked the button 'SELECT EXISTING CLIENT', a pop-up menu will appear and you can select the client from the dropdown list of existing clients.

Alternatively, enter the company name, UTR and VAT registration number.

Select the appropriate VAT scheme.

Unless you are an agent, new users will need to authorise Ftax with HMRC before continuing. To grant authority, click the 'AUTHORISE TAX FILER FOR MTD' button.

This will take you to the correct section of the HMRC website. Click 'Continue',

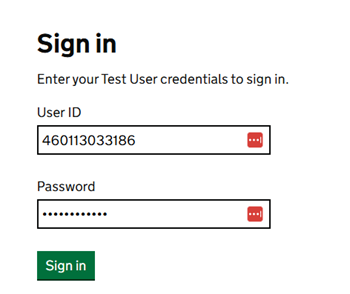

and sign in to the HMRC online services using your Government Gateway User ID and Password.

When you have signed in, click 'Give permission'. Please note that granting authority must be done through the form.

Click 'CHECK MTD AUTH'.

If authority has been granted, a tick will appear in the authorise Ftax for MTD section of the overview.

Click 'DISPLAY PERIODS'.

Select the period required.

If necessary, the form will prompt you to buy a credit. To do this, click 'BUY CREDITS.'

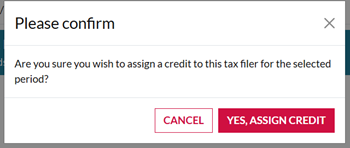

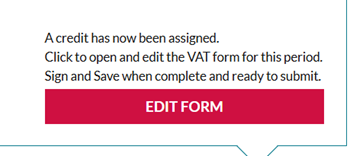

If you already have a credit, click 'CREDIT' and then agree with the pop-up to assign the credit.

Next, click 'EDIT FORM'.

Click 'Import' to upload a CSV file of the 9 values which you need to complete the VAT form.

The format required for this data is displayed in the pop up.

If you wish to declare a nil return, click 'Fill nil return.'

When your data has been uploaded, sign the form,

Save it,

And click 'Back to Overview' to return to the overview.

If you are an agent, you may wish to create a PDF copy for your client before submission. Please note that there is no IR mark on this PDF copy.

Agree with the declaration and click 'SUBMIT'.

You can create a post-submission PDF copy which includes a confirmation of submission ID generated by HMRC.

If you haven't already set up a direct debit to pay your VAT, click 'PAY HMRC' to be taken to the relevant part of the HMRC website.

You will receive an email from Ftax confirming submission. This will also contain the HMRC receipt ID.

![]()

We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

![]() T

T