We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

Ftax Setup Checklist – Step by Step Instructions

This guide covers how to download an Ftax form, setup your computer to work efficiently and safely with the Ftax form and allocate a credit so that the form is ready for use.

This guide is broken down into the following steps:

- Download the form

- Login to your account

- Allocate a Credit

- Troubleshooting Errors

1. Download the form:

When you have purchased an Ftax form or package of forms from our website, you will be able to login to your user, go to the Downloads tab on ‘Account Home’ and click to download a copy of the form. This applies regardless of which browser you use:

Download the latest Ftax form to your computer, save it in a known location and open with a recent version of Adobe Reader. If using a Mac, be careful not to open the form in Preview. If you have never used an Ftax form on this computer before, you should now see the following screen. You will need to comply with this before you can continue:

Select Edit, Preferences, JavaScript if you are using Windows (or Adobe Reader, Preferences, Javascript if using a Mac). Make sure the top box, ‘Enable Acrobat JavaScript’ is ticked, the next two boxes are not ticked and the bottom box is ticked. Click ‘OK’.

Then select Security Enhanced’, again on the ‘Edit’ menu, and untick the ‘Enable Enhanced Security’ box:

Please note: It is advised that this setting is turned back on once you have completed and submitted your form.

![]()

2. Login to your account:

Log in to your Ftax account. A login pop-up should appear when you click ‘Continue’ on the Special Notice screen and then again on the next screen. If it doesn’t, click the question mark in the small red ball towards the centre of the screen and choose the bottom option.

Be careful not to confuse your HMRC user ID and password (which should be entered on the form) with your Ftax account username and password.

You are advised to make sure that the ‘Do NOT login to my Ftax Account’ box is unticked and that the ‘Save login details on computer’ is ticked so that you remain automatically logged in.

![]()

3. Allocate a Credit:

The number of credits remaining is displayed towards the bottom left of the Ftax form:

When a new UTR is entered, a pop-up should prompt you to allocate a credit. Another pop-up will confirm when the credit has been allocated. At this point, a credit code will automatically be transferred, allowing the form to calculate and submit. If you enter a UTR that already has a credit allocated, then you’ll be allowed to continue without allocating another credit.

Please note that you must enter the name before the UTR. If you haven’t already done so then the cursor will automatically move to the ‘name’ box.

![]()

4. Troubleshooting Errors:

- ‘SOAP service is undefined’ message and a ‘Communication Problem‘ message. In both cases, you should:

- Check your internet connection and

- Check that you have fully complied with the Special Notice (see above).

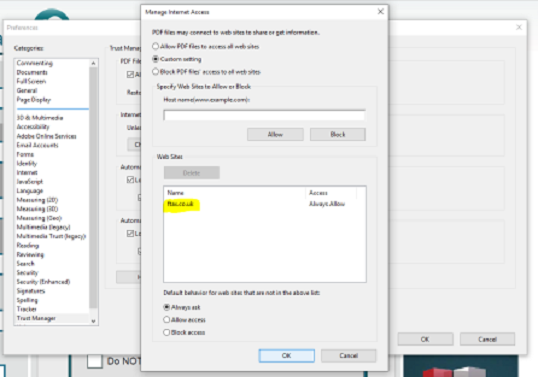

- If the problem persists, check that your computer ‘trusts‘ ftax.co.uk. To do this, go to Edit, Preferences, Trust Manager (Adobe Reader, Preferences, Trust Manager on a Mac) and ensure that ftax.co.uk is trusted by checking that it appears when you click on in the ‘Change Settings‘ button in the ‘Internet access from PDF Files from outside the web browser’ section:

- They may also appear when you are using an old version of Windows (namely XP or Vista), with the latest version of Adobe Reader. This is because Adobe no longer supports these older versions. If this happens, then either update Windows or install an older version of Adobe Reader by going to the Adobe website, finding ‘get reader’, and selecting ‘other languages and versions’

- A pop-up asks you for a four digit credit code:

This means you are not logged in to your Ftax account. The Ftax form will prompt you to login. Login and you will be able to continue to enter the UTR. The login pop-up can be displayed at any time by clicking the question mark in a red ball on the opening page of the Ftax form and selecting the bottom option.

![]()

Still Having Problems?

Please check the following:

- Your internet connection is functioning normally

- You are logged in to your Ftax account

- You have ticked ‘Enable Acrobat JavaScript’ on the Edit, Preferences, JavaScript menu

- You have NOT ticked ‘Enable menu items JavaScript execution privileges‘ or ‘Enable global object security policy‘ on the above menu

- You have ticked ‘Show console on errors and messages‘ on the above menu

- You have NOT ticked ‘Enable enhanced security‘ on the Edit, Preferences, Security (Enhanced) menu

- Your computer ‘trusts‘ Ftax.co.uk (see above)

- You are using a suitable version of Windows and Adobe Reader.

If you are still experiencing problems and our video on this subject does not provide you with an answer, you can contact Ftax Support via our website.

Important: while the ‘enable enhanced security’ box is unticked, you are advised not to open PDF attachments emailed from unknown addresses. You may wish to leave the ‘enable enhanced security’ box ticked when you are not using Ftax.

![]()