We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

Ftax Cashbook Setup for Businesses – Step by Step Instructions

This guide covers how to set up the Ftax Cashbook for individuals and businesses. If you are an agent, please see the video ‘Ftax Cashbook Set up for Agents’. The guide is broken down into the following steps. How to:

- Download the Cashbook

- Log in to your account

- Allocate a Credit

- Import previous Cashbook data

- Enter business details

![]()

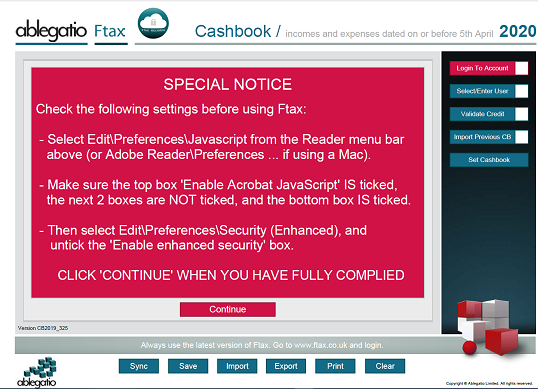

1. Download the Cashbook:

Download the Cashbook and open it with Adobe Reader. If this is the first time you have used an Ftax product, a ‘Special Notice’ will be displayed. You must comply with this before you continue. Further details are available in the video ‘Ftax Setup Checklist.’

You can look at the ‘Special Notice’ at any time by clicking the question mark in the red ball on the front page of any Ftax form:

![]()

2. Log in to your account:

To use the Ftax Cashbook, log in using your Ftax account Username and Password:

Next, go to Select/Enter User and if you have used Ftax via this account before, select your name or company name from the drop down lists:

Alternatively, select ‘New Individual’ and enter your name and UTR:

![]()

3. Allocate a credit:

Click ‘Validate Credit’ and a pop up will ask if you wish to allocate a credit:

Click ‘Yes’ and a pop up will appear to confirm that a credit has been allocated.

![]()

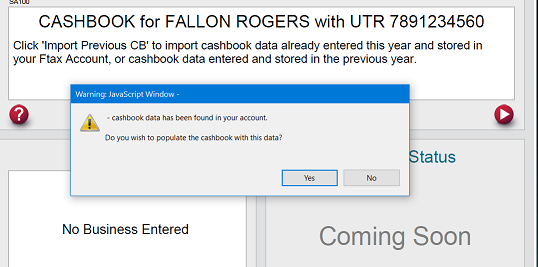

4. Import Previous Cashbook Data:

If an Ftax Cashbook with this UTR has been used before, then you will be prompted to click ‘Import Previous Cashbook’ to import the existing Cashbook data, either from this tax year or from the previous tax year:

Otherwise, the box will be ticked for you and the focus moved to the next button.

Finally, click the ‘Set Cashbook’ button and save the file in a known location:

You will be able to download updates and set up a new form for yourself again at any time without using up another credit.

![]()

5. Enter business details:

Begin by entering your business details:

If you are VAT registered, you can calculate your liability using either the Standard or Flat rate scheme. Further schemes may be added in the future:

Businesses may also be set up for either Standard or Cash Based accounting:

The bookmarks on the left can be used to navigate to the Incomes, Expenses, Customers and Suppliers pages:

Income and expense data can now be added:

Frequently used customers and suppliers can now be added:

Further information on the VAT pages of the Cashbook are available in the video and guide Cashbook Overview for Businesses and Ftax VAT Overview for Businesses.