Capital Gains Worksheet

We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

Capital Gains Worksheet – Overview

This guide is an overview of the Capital Gains Worksheet which is found in the Ftax SA100 form. If the tax filer has capital gains to declare, then the Ftax SA100 capital gains section will need to be completed.

![]()

1. Navigate to the Capital Gains Worksheet:

You can navigate to the Capital Gains summary section using the bookmark on the left or by clicking the 'Capital Gains' button on the navigation panel on the right.

![]()

2. Add Data to the Capital Gains Worksheet:

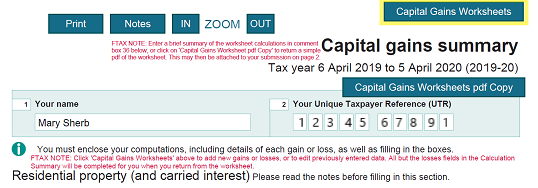

You can either enter sub-totalled Capital Gains data manually into boxes 14 to 44, or click the Capital Gains worksheet button to enter each gain separately.

Click 'Next Gain' to add new gains or losses or click 'Previous Gain' to edit previously entered data.

When you have finished entering your data into the Capital Gains worksheets, click “Back to return”.

All fields containing calculations (other than those concerning losses) will be completed for you when you return from the worksheets.

![]()

3. Submit Online

When you submit online, enter a brief summary of the worksheet calculations in comment box 54 or click on 'Capital Gains Worksheets PDF Copy' to generate a simple PDF of the worksheet. This may be accessed via your Ftax account and can be attached to your submission on page 2.

A receipt will appear and you should receive an email shortly with instructions on how to download the PDF. Once downloaded, it may be attached to a client email, attached to the tax return, used to print more flexibly or simply saved in your files.

![]()

We are very grateful to our clients for their comments and suggestions, without which these guides would not be possible.

If you have a suggestion to improve this guide or its associated video, please email tracey@ftax.co.uk

![]()